vermont sales tax calculator

An additional local option tax might also be collected by the cities and towns in Vermont which. Vermont state does have local sales tax so the total sales tax rate could include a combination of state county city jurisdictions and district tax rates.

Vermont Sales Tax Small Business Guide Truic

The base state sales tax rate in Vermont is 6.

. The average cumulative sales tax rate in Island Pond Vermont is 6. Huntington is located within Chittenden County Vermont. Sales Tax calculator Vermont.

Island Pond is located within Essex County VermontWithin Island Pond there is 1 zip code with the most populous zip code being 05846The sales tax rate does not vary based on zip code. Vermont Sales Tax Rate The sales tax rate in Vermont is 6. If this rate has been updated locally please contact us and we will update.

Vermont sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Vermont Income Tax Calculator 2021. The items that are non-taxable are clothing groceries prescription and non-prescription drugs.

How to Register for Vermont Sales Tax. You can use our Vermont Sales Tax Calculator to look up sales tax rates in Vermont by address zip code. 2020 IN-152A Annualized VEP Calculator.

In Vermont acquire a sellers permit by following the department of taxes detailed instructions for registration. Rates include state county and city taxes. Sales tax data for Vermont was collected from here.

Theres also a 9 room tax applicable to hotel and meeting room rentals. This includes the rates on the state county city and special levels. Well speaking of Vermont the rate of the general sales tax is 6.

Sales and Gross Receipts Taxes in Vermont amounts to 12 billion. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Vermont local counties cities and special taxation. This is a printable Vermont sales tax table by sale amount which can be customized by sales tax rate.

2020 IN-152 Underpayment Adjustment Calculator. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and. Calculator Fri 02192021 - 1200.

In zip code Enter the zip code where the purchase was made for local sales tax. Exemptions to the Vermont sales tax will vary by state. The state sales tax rate in Vermont is 6.

Vermont sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Tax rate necessary to raise the same amount of sales tax as in 2019 assuming 2019 sales levels and assuming full protection for low-income Vermoners appears at the bottom in cell F37.

Numbers represent only state taxes not federal taxes. 2021 Property Tax Credit Calculator. These are only several examples of.

This includes the rates on the state county city and special levels. To document additional taxes collected as a result of excess wear and tear andor excess mileage at the end of a motor vehicle lease contract. Find your Vermont combined state and local tax rate.

As a Streamlined Sales Tax state Vermont encourages out-of-state sellers without a sales tax obligation to register with the state and collect. The sales tax rate does not vary based on zip. Underpayment of 2020 Estimated Individual.

Local tax rates in Vermont range from 0 to 1 making the sales tax range in Vermont 6 to 7. Sales Tax Calculator Sales Tax Table. Vermont has a 6 general sales tax but an additional 10 tax is added to purchases of alcoholic drinks that are immediately consumed.

Before-tax price sale tax rate and final or after-tax price. The sales tax rate for Dover was updated for the 2020 tax year this is the current sales tax rate we are using in the Dover Vermont Sales Tax Comparison Calculator for 202223. If you make 70000 a year living in the region of Vermont USA you will be taxed 12902.

This chart can be used to easily calculate Vermont sales taxes. Within Huntington there is 1 zip code with the most populous zip code being 05462. Vermont Sales Tax Calculator Purchase Details.

Check your local Vermont sales tax rates using the TaxJar sales tax calculator. The Vermont Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Vermont in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Vermont. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish. Vermont has a 6 statewide sales tax rate but also has 207 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0092 on top of. To apply for a lesser tax due at the time of registration when disagreeing with NADA value.

It is 3405 of the total taxes 34 billion raised in Vermont. Vermont has a 6 statewide sales tax rate but also has 153 local tax jurisdictions including. Calculator Mon 02082021 - 1200.

Tax Year 2020 State of Vermont Annualized Income Installment Method. 31 rows The latest sales tax rates for cities in Vermont VT state. The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax.

Once you have chosen all the categories to include you can input a tax rate in cell E43 highlighted in green and cells E44 and F44 will tell you how much. ICalculator US Excellent Free Online Calculators for. Sales tax in Dover Vermont is currently 7.

The transfer of taxable tangible goods and services is subject to Vermont sales tax. Your household income location filing status and number of personal exemptions. The average cumulative sales tax rate in Huntington Vermont is 6.

Calculator Tue 02162021 - 1200. 2020 rates included for use while preparing your income tax deduction. Five states have no sales tax.

54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. How much is sales tax in Dover in Vermont. Your average tax rate is 1198 and your marginal tax rate is 22.

Sales of prewritten computer software have been subject to sales tax in Vermont since July 1 2014. Colorado has the lowest sales tax at 29 while California has the highest rate at 725. Lease Excess Wear Tear Excess Mileage Tax.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Vermont Sales Tax Rates By City County 2022

Vermont Sales Tax Information Sales Tax Rates And Deadlines

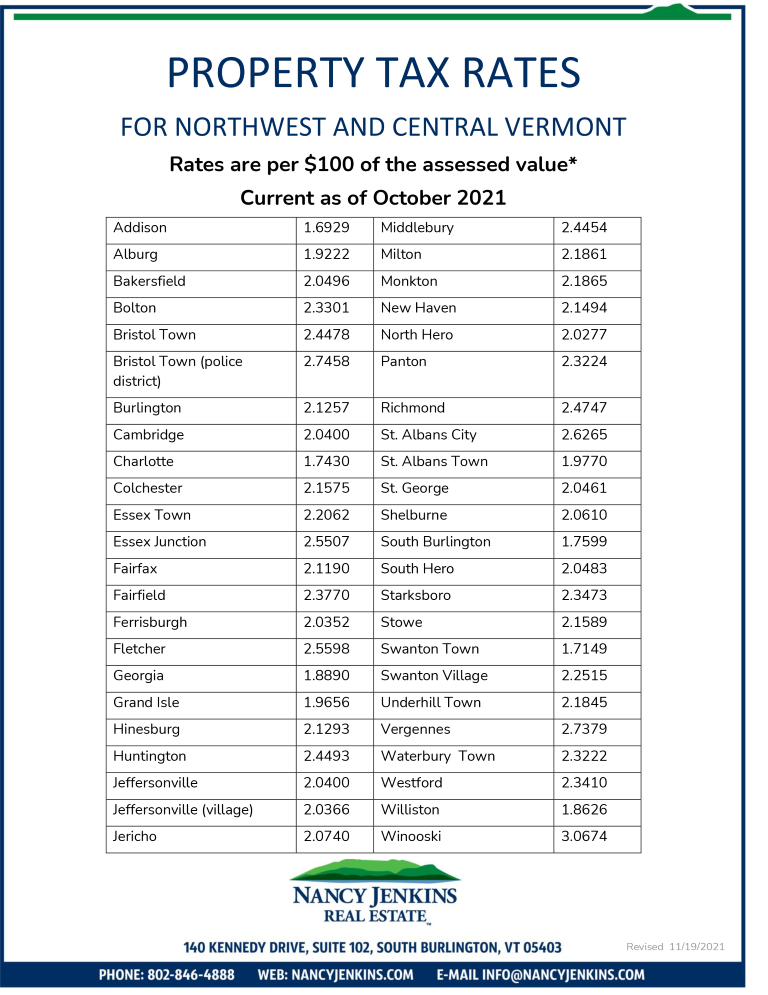

Vermont Property Tax Rates Nancy Jenkins Real Estate

Vermont Income Tax Calculator Smartasset

Vermont Income Tax Calculator Smartasset

Printable Vermont Sales Tax Exemption Certificates

States With Highest And Lowest Sales Tax Rates

How To Register For A Sales Tax Permit Taxjar

Vermont Real Estate Transfer Taxes An In Depth Guide

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Taxes In The United States Wikiwand

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Vermont Income Tax Calculator Smartasset